What is a Shooting Star?

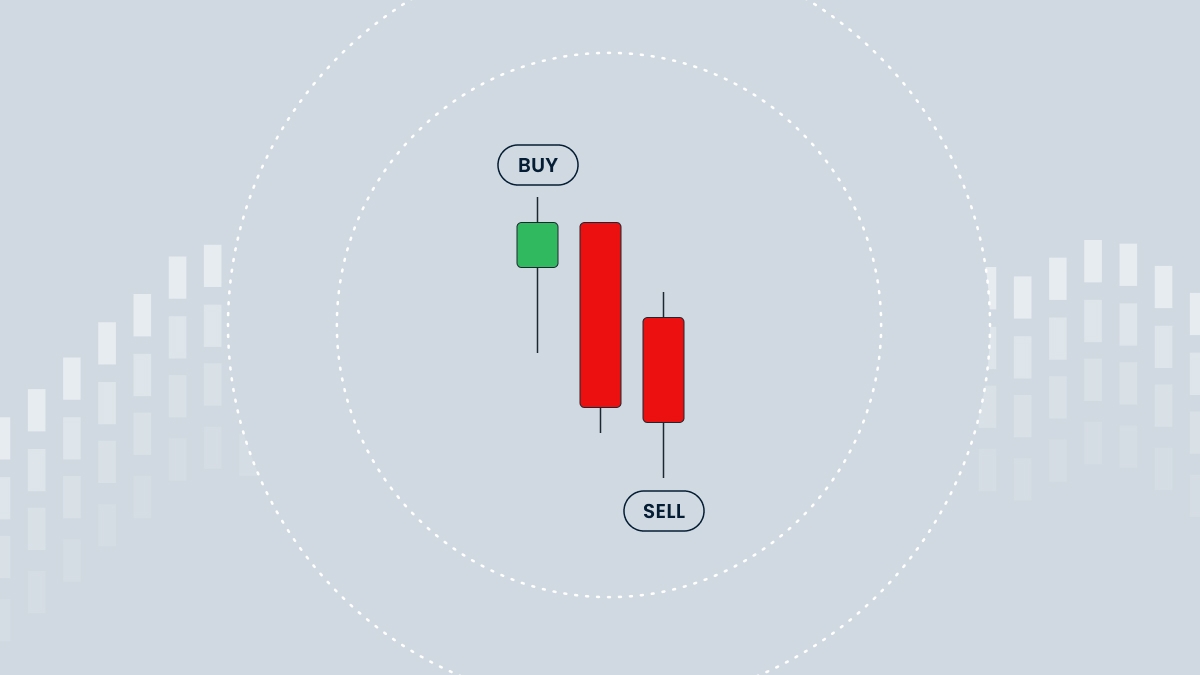

A Shooting Star is a potent bearish candlestick pattern generally occurring at the end of a prolonged uptrend and before a reversal to a downtrend.

This pattern consists of a single candlestick, but what’s unique about it is the body: a Shooting Star candle has a small real body near the day’s low. This happens because the price of an asset closes near its opening price, showing that the bulls hadn't managed to raise the price in the span of that day.

At the same time, the upper wick of a Shooting Star candle is really long, at least twice the length of its body. The lower wick is barely visible, sometimes even non-existent, so the most recognizable part of this pattern is its long upper wick.

What does a Shooting Star pattern mean?

A Shooting Star pattern usually occurs after a steady and prolonged uptrend, often after at least three consecutive bullish candles. It can also appear after a few bearish candlesticks, provided that the overall price movement has strong bullish tendencies.

The small body and the long wick of a Shooting Star indicate that the bulls dominating the market had tried to push the price even higher when the day started. But the higher price swiftly attracted more bears who, in turn, pulled the price back down almost to the opening level.

This pattern shows that bulls might be losing their grasp on the market and signifies a potential shift in market sentiment from bullish to bearish. The buying pressure gives in to the force of the selling pressure, giving traders a sign that the prevailing uptrend may weaken and potentially indicating an impending trend reversal or a significant pullback.

The pattern is considered confirmed if the following candlestick is bearish and closes lower. The upper wick of the successive candle should be shorter than the high of the Shooting Star. If it is, there is a very high chance that bears have managed to take over the market, so traders may attempt to use this opportunity to place sell orders.

How to trade a Shooting Star

To make the most of a Shooting Star pattern, consider the following steps:

Identify an uptrend. A Shooting Star is more reliable when it occurs during a prolonged uptrend. Even though the price never moves in a straight line, each consecutive peak and trough are higher than the previous ones. To identify an uptrend, look for a series of higher highs and higher lows that indicate a clear upward trajectory.

Look for a Shooting Star pattern. Scan the chart for a candlestick with a small body near the day's low, a long upper wick at least twice the length of the body, and a short lower wick.

Validate with additional indicators. To get a fuller picture on the possibilities of a reversal, make use of technical analysis indicators. With them, you can measure other parameters of the current price action, such as trend direction, trading volume, price momentum, support/resistance levels, etc. If other indicators give strong reversal signals, you have more reasons to believe that the Shooting Star pattern will lead to a change in the direction of price movement.

Plan your trade. Spotting any chart pattern gives you a unique opportunity to plan your entries and exits. Once a Shooting Star is confirmed, you may establish an entry point at the level a confirmation has occurred, set a stop-loss order above the upper wick to manage risk, and determine a profit target based on your trading strategy and risk-reward ratio.